Stockholm 22 October, 2015: A group of about 15 economics and environmentally-engaged professionals met to participate in the Foundation’s first public simulation of dividend-bearing pollutant fees. The idea is to levy fees to make environmentally bad behaviour expensive and good behaviour cheaper.

In other words, the simulation aims to demonstrate how this market-based instrument can stimulate the market to invest in sustainable technology to reduce emissions whilst maintaining a robust and stable economy for commercial actors and consumers.

The challenge

The simulation explores the somewhat challenging territory where economy and environment overlap. The fundamental question is; is it possible to both have a robust economy and manage the environment responsibly at the same time? How do we address the risk that we might bring about a double negative; destroy the environment and valuable resources whilst depleting the economy?

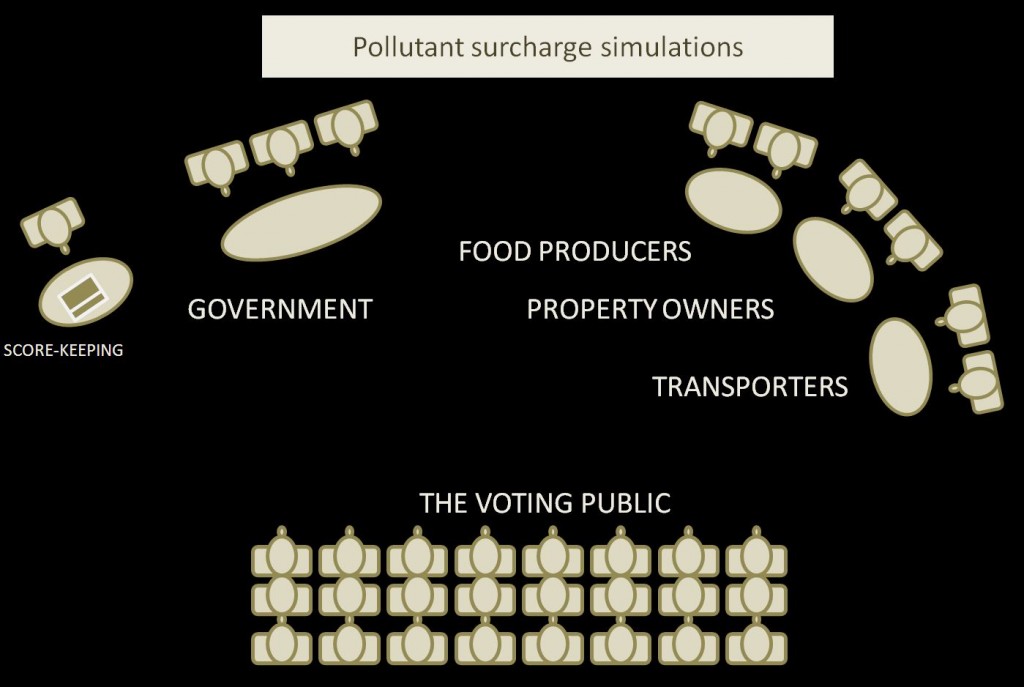

The teams

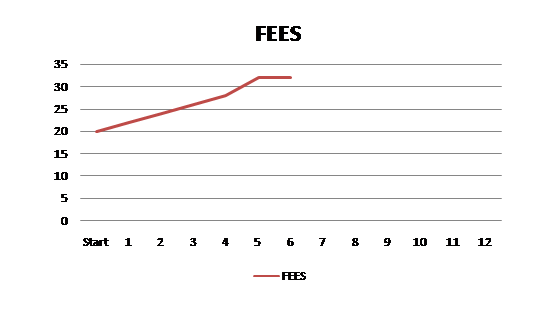

The simulation comprised of four teams and a pre-programmed fifth team – the environmental company. The first team, the government commission, is charged with raising fees on pollutants at regular intervals. The fees are levied as surcharges on usual fees and taxes upon introduction of the pollutant into the country, For example: fossil fuels carry a climate supplement levy on import.

The government commission has the power to redirect the fees levied back into citizens’ pockets via the repayment of a dividend. They decide at each round what percentage of the collected fees to redistribute.

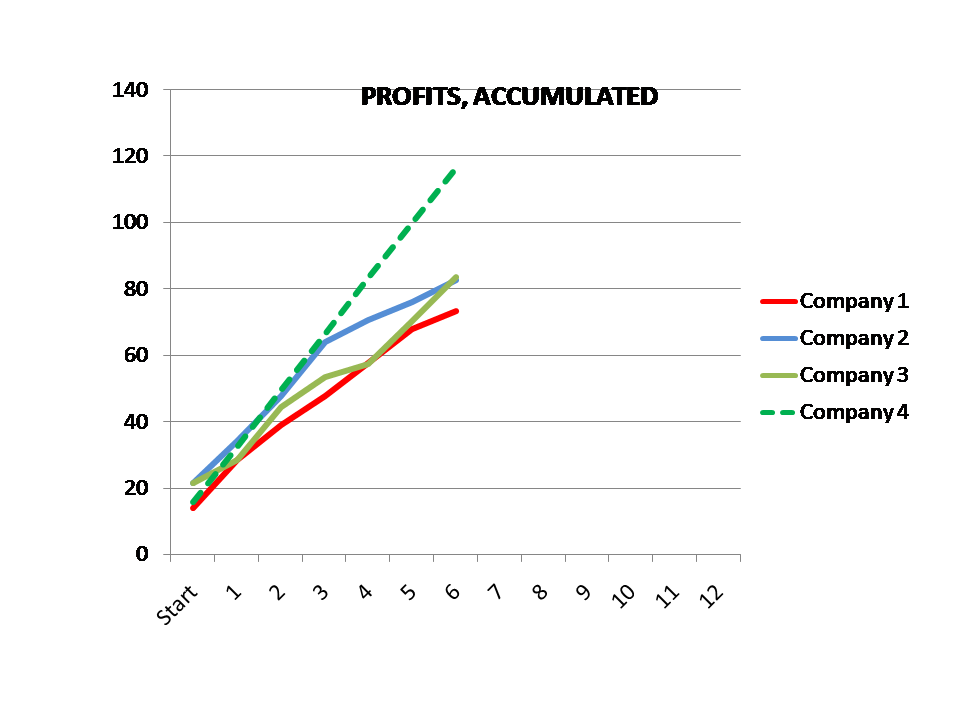

The other three teams represent companies that use inputs causing pollution. As the fees are raised, so does the cost of inputs. These firms are given the choices of raising prices to compensate for increased costs and/or investing in sustainable technology to remove input costs.

The environmental robot to compete against

The fourth team, “company four”, was a ‘robot controlled’ company. The prices were higher, but there were no costs for inputs since the company was already fully invested in circular technology (i.e. extracting raw materials from their own business processes). In the robot-controlled company profits are at a similar level to the other companies.

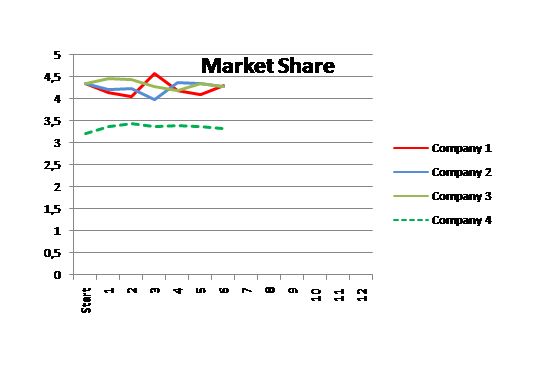

As prices rose, market shares adjusted accordingly. Company four, with the highest prices initially, had the lowest market share.

The simulation engine.

The decisions of each team are fed into a computer and the results are presented as scores in the form of graphs.

Confidence in Government

At the end of each “investment round” all participants voted on their confidence in the government.

It was with some excitement that we set about exploring these somewhat controversial issues. We were lucky that we had people with so many different viewpoints in the room, something that ensured a good learning session.

RESULTS

General impressions:

Not everyone is familiar with the concept of how to put a price on the environment using market-based instruments. We felt is was important that the information was clear so that non-economists could understand the basics of national economy, and non-environmentalist could understand the basic of the non-emitting and circular economy.

Dividend-bearing pollutant fees are:

- A fee on introduction of the pollutant into the economy. This is levied as far up the supply chain as possible.

- The fee is raised at regular intervals, looking carefully at the performance of the market.

- Money collected from the fee goes back to citizens to ensure that the economy is not hurt.

For economists, three examples of we are trying to avoid is

- Depletion of fossil fuel assets, the mass combustion of which disrupts the climate system.

- Disruption of the natural nitrogen cycle by allowing accumulation in nature, disrupting natural water processes.

- Drawing down of mineral phosphorus resources and release into the natural environment where it disrupts natural water processes.

- A lack of phosphorus supplies (essential for food production) from recycling processes.

Nitrogen and phosphorus are both essential to societal processes, but become pollutants when allowed to accumulate in natural systems. The aim is responsible management (reuse and recycle) of these resources.

The good news:

The government acted decisively, regularly increasing the fees on pollutants.

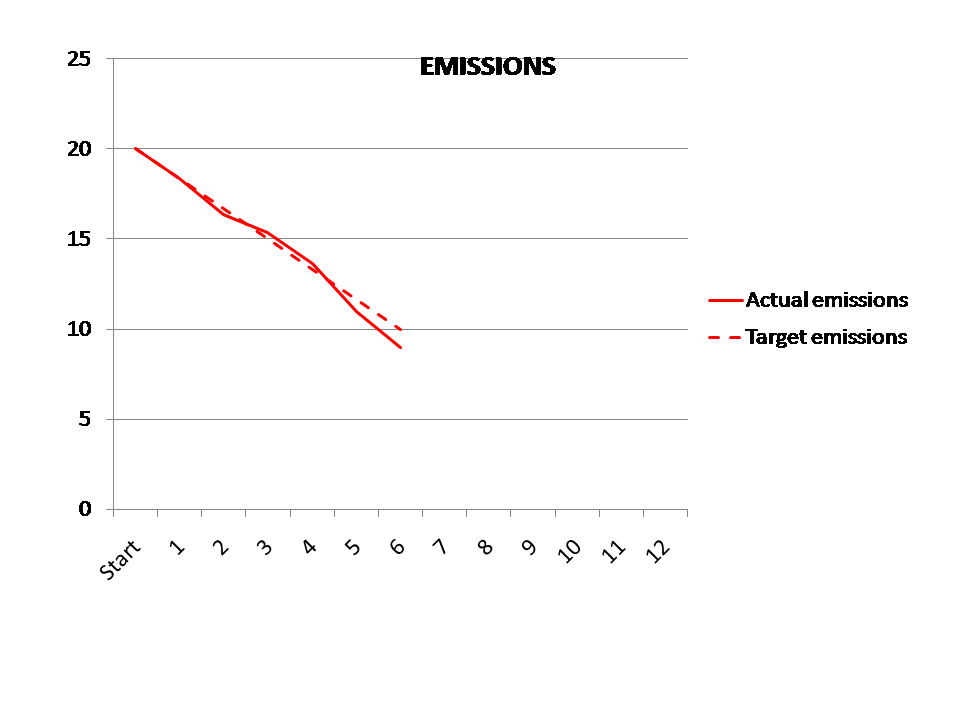

The graph of emissions reduction followed the Government target relatively closely.

Profits continued to accumulate in all participating companies.

Public confidence grew. At first.

The results graph above shows how popularity rose as emissions fell and the redistribution (repayment) of pollutant fees increased spending power. That is, until the effects of the investments in circular economy reduced import of the pollutant-causing materials. Fees were higher, but as total volume fell so did overall income from fees.

Competition appeared to be working, with companies adjusting prices to gain market share.

What did we learn?

Things that helped the players fulfil the aim of the simulation:

- The goals for abatement were clear and the government commission players were bold in their application of fees. By choosing to redistribute the money collected back to citizens they kept spending power up.

- Companies were not shy in acting by investing. Nor in raising prices, which helped to keep up profits whilst investing in circular technology.

- Communication: Several statements by “the government” helped increase confidence that they were steadfast in fulfilling policy as well as being open to comments and input from the companies.

-

Staffan Lindberg at an earlier event Photo: Kristina Hellberg Culture: Carbon dioxide dieter and troubadour Staffan Lindberg enlivened the mood with his songs. Staffan helped consumers, voters, government and scientists to focus on creating a culture of pollutant reduction.

What can we learn and take away from the workshop?

Levying fees on introducing potential pollutants into the economy can stimulate the market to manage materials responsibly.

We learnt from the simulation that communication is needed and vital, with an open dialogue, and the creation of trust to develop a culture of non-pollution. Pollutant fees that are flexible and dynamic, bearing a dividend back into the economy could be an important tool and feature of that culture.

We saw the importance of art and culture in the process.

Tax and forget is not a safe strategy. In a dynamic situation it is of great importance to closely monitor the behaviour of the economy and adjust accordingly. The economic control signals created by a proper use of tools and instruments such as fees and dividends, together with a clear and transparent communication should, however, be sufficient to steer an economy to sustainable circularity.

For more information

- Contact us if you are interested in running version of the simulation in your organisation

- EFR: an introduction

- Flexible pollutant fees: the video

- Staffan Lindberg